CA DE 9ADJ 2013-2024 free printable template

Show details

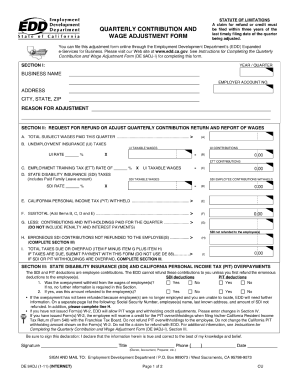

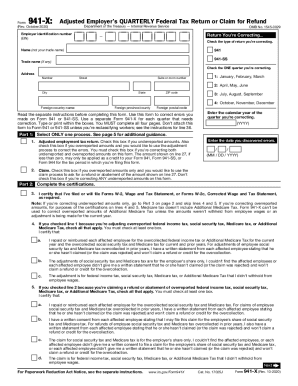

00 times B. E. EMPLOYMENT TRAINING TAX ETT Rate 0. 00 times B. I. Penalty Refer to instructions on DE 9ADJ-I. J. Interest Refer to instructions on DE 9ADJ-I. K. Erroneous SDI Deductions not refunded See Box 1 NOTE below. O. Box 989073 / West Sacramento CA 95798-9073 DE 9ADJ Rev. 3 7-13 INTERNET Page 1 of 2 CU SECTION III QUARTERLY WAGE AND WITHHOLDING ADJUSTMENTS Enter amounts that should have been reported if unchanged leave field blank. Correcting the Social Security Number or Name requires...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ca edd de 9adj form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca edd de 9adj form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ca edd de 9adj form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit california quarterly contribution form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

CA DE 9ADJ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ca edd de 9adj

How to fill out edd quarterly wage form:

01

Obtain the edd quarterly wage form from the Employment Development Department (EDD) website or your local EDD office.

02

Fill in your personal information accurately, including your name, social security number, and contact details.

03

Provide your employer's details, such as their name, address, and EDD employer account number.

04

Report your wages for each calendar quarter in the designated sections, ensuring that you include all income earned during that period.

05

Calculate your total taxable wages and enter the sum in the appropriate box.

06

If you have any deductions or credits, such as retirement contributions or healthcare deductions, make sure to deduct them from your taxable wages.

07

Review the form for any errors or omissions before submitting it.

08

Sign and date the form, indicating that the information provided is accurate and true to the best of your knowledge.

09

Keep a copy of the filled-out form for your records.

Who needs edd quarterly wage form:

01

Individuals who are employed or have income subject to California state taxes.

02

Employers who are required to report their employees' wages for taxation purposes in California.

03

Self-employed individuals who need to report their income and are liable for California state taxes.

Video instructions and help with filling out and completing ca edd de 9adj form

Instructions and Help about de9 adj form

Fill de 9adj : Try Risk Free

People Also Ask about ca edd de 9adj form

What does wage item count mean on EDD?

What is the de 9 quarterly contribution return and report of wages?

What is the de 9 report of wages?

What is a de 9C report?

What is EDD quarterly threshold penalty?

What is CA DE 9?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is california 9adj?

There is no specific term or phrase "california 9adj" that is widely known or used. It seems to be a combination of the word "California" and the abbreviation "9adj". Without any further context, it is not possible to determine its meaning or significance.

Who is required to file california 9adj?

The term "California 9adj" does not refer to a specific form or tax obligation. Therefore, it is not possible to determine who is required to file California 9adj without further clarification. Please provide more specific information or consult a tax professional for assistance.

How to fill out california 9adj?

To fill out California form 9ADJ, which is a Claim for Homeowners' Property Tax Exemption, follow these steps:

1. Obtain the form: You can download the form from the official website of the California State Board of Equalization or visit your local county assessor's office to obtain a physical copy.

2. Personal Information: Fill in your personal information at the top of the form, including your name, address, city, state, and ZIP code.

3. Property Information: Provide details about the property for which you are claiming the homeowners' property tax exemption. This includes the location of the property, its Assessor's Parcel Number (APN), and the date you acquired the property.

4. Eligibility Requirements: Answer the questions regarding your eligibility for the homeowners' property tax exemption. This includes confirming that the property is your principal residence and that you meet the necessary requirements like ownership and occupancy criteria.

5. Certification: Sign and date the certification section affirming that the information provided on the form is accurate and complete. If you are completing the form on behalf of someone else, you may need to provide additional documentation or a power of attorney.

6. Submitting the Form: After completing the form, make a copy for your records and submit the original to your local county assessor's office. You may need to include additional supporting documentation as required by your county assessor, such as proof of residence or ownership.

It is important to note that the specific instructions and requirements may vary depending on your county. Therefore, it is advised to carefully read the instructions provided on the form itself or consult with your local county assessor's office for any additional guidelines.

When is the deadline to file california 9adj in 2023?

The deadline to file California Form 540 2EZ for tax year 2023 is typically April 15, 2024. However, please note that tax deadlines can change, so it's always a good idea to verify with the California Franchise Tax Board or consult a tax professional for the most up-to-date information.

How can I send ca edd de 9adj form to be eSigned by others?

Once your california quarterly contribution form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete edd quarterly wage form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your edd wage adjustment form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out wage adjustment on an Android device?

Complete edd adjustment form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your ca edd de 9adj online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Edd Quarterly Wage Form is not the form you're looking for?Search for another form here.

Keywords relevant to edd adjustment form

Related to edd quarterly wage

If you believe that this page should be taken down, please follow our DMCA take down process

here

.